The world of cryptocurrency trading can seem daunting, especially for a **Crypto Newbie** trying to navigate volatile markets. Successfully engaging in this high-stakes environment often requires significant capital and a disciplined strategy. This is where the concept of a prop trading firm, and specifically **trade the pool The Program**, comes into play, offering a structured pathway to trade with a firm’s capital.

This comprehensive guide will provide a professional, in-depth analysis of the **trade the pool program**, outlining its structure, the evaluation process, and how a beginner can leverage it while developing the crucial skills for trend prediction in the digital asset space. We aim to maximize your understanding and prepare you for a professional **trade the pool funded program**.

The Trade the Pool Program Structure: A Beginner’s Pathway

Trade the pool is a proprietary trading firm that offers a unique opportunity for traders to prove their skills and, upon successful completion of an evaluation, trade the firm’s capital. This model significantly reduces the initial capital risk for the individual trader while providing a high-potential reward structure.

Newbie Advantage: For a **Crypto Newbie**, the **trade the pool program** is an unparalleled opportunity. It allows you to skip the years required to build substantial personal capital and immediately begin focusing on mastering market execution and professional risk control.

Understanding the Trade the Pool Evaluation Program

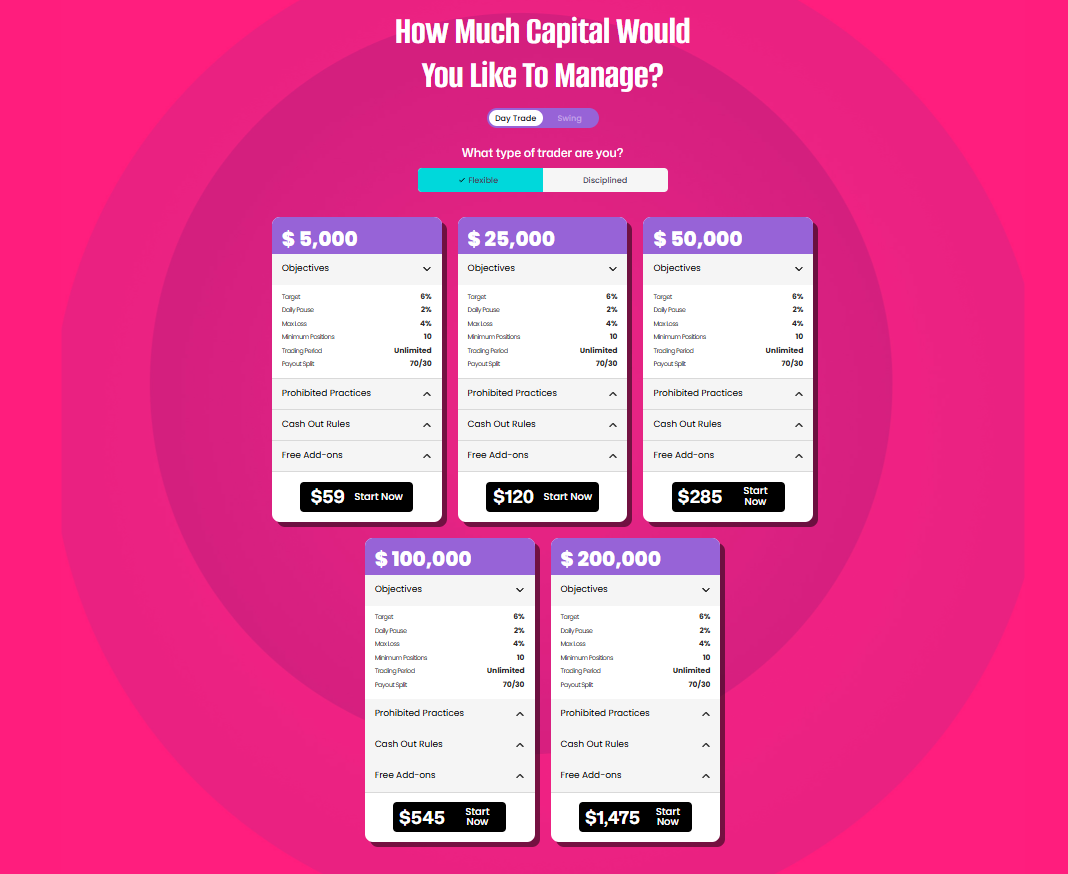

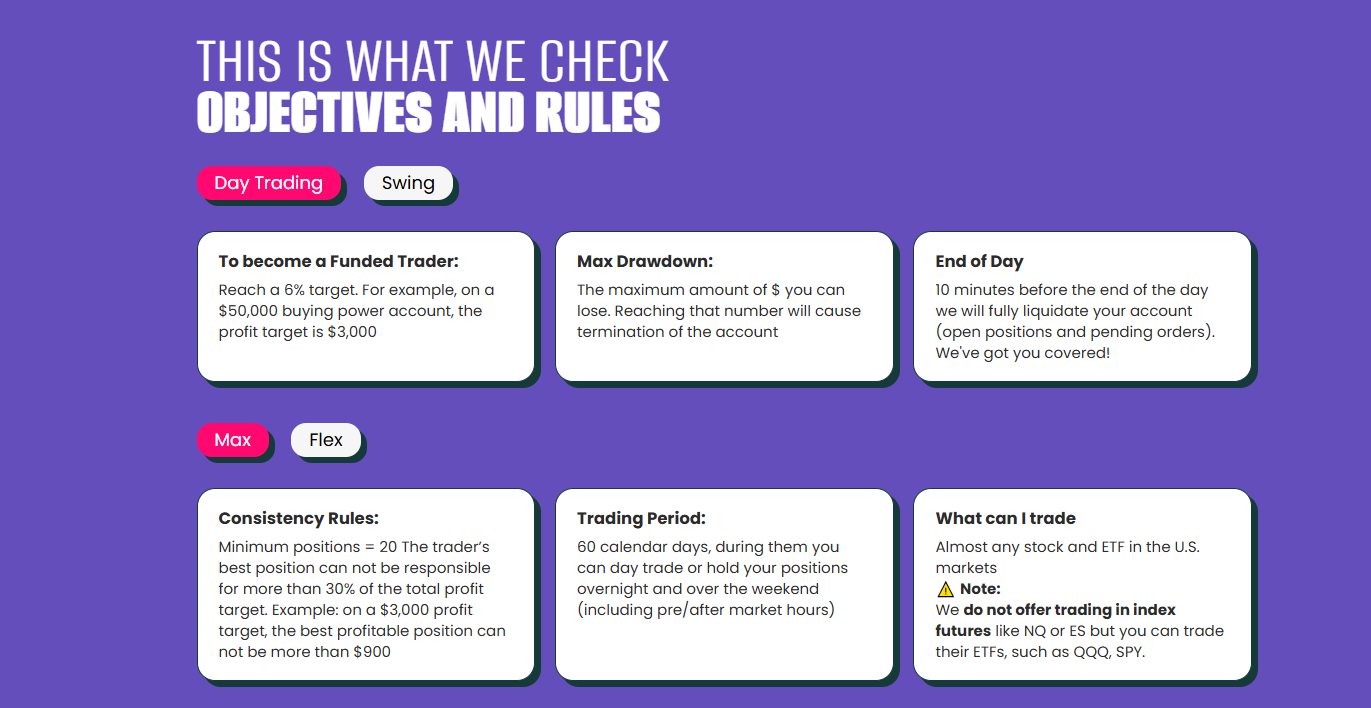

The journey to becoming a funded trader typically starts with the **trade the pool evaluation program**. This phase is designed to assess a candidate’s trading aptitude, risk management capabilities, and consistency. It’s a rigorous test, but essential for the firm to ensure capital protection.

- Objective Metrics: The evaluation usually involves meeting a specific profit target within a defined timeframe without violating maximum drawdown or daily loss limits. These metrics enforce discipline—a vital skill for any serious trader.

- Risk Management Focus: For a **Crypto Newbie**, the focus on risk management is arguably the most valuable part of the evaluation. Unlike self-funded accounts where emotional decisions can lead to total loss, the prop firm’s rules instill a non-negotiable framework for mitigating risk.

- Proof of Concept: Successfully passing the evaluation validates your strategy and ability to consistently generate profits under pressure.

Transition to the Funded Program

Once a trader successfully navigates the evaluation, they graduate to the **trade the pool funded program**. This is the ultimate goal, where the trader is allocated a substantial trading account funded by the firm. The firm bears the capital risk, and the profits are shared according to an agreed-upon split.

This setup democratizes professional trading. Individuals who previously lacked the resources to trade large sizes can now operate at a professional level.

Cryptocurrency Trend Prediction: A Deep Dive for Newbies

To succeed in any **trade the pool prop program**, and especially within the volatile crypto markets, one must master the art of trend prediction. This requires a professional blend of technical and fundamental analysis.

Leveraging Technical Analysis Methodologies

Technical analysis (TA) is the study of historical price action and volume to predict future movements. For the **trade the pool trading program**, a firm grasp of TA is non-negotiable.

- Support and Resistance: These are price levels where the majority of buying or selling pressure occurs, acting as potential turning points.

- Candlestick Patterns: Interpreting individual and clustered candlesticks can reveal market sentiment and foreshadow reversals or continuations.

- Volume Analysis: High volume accompanying a price move lends credibility to the trend, confirming the market’s conviction.

- Indicators and Oscillators: Tools like the Relative Strength Index (RSI) or Moving Averages help identify overbought/oversold conditions and trend direction.

For a more comprehensive understanding of these essential tools, review our guide on technical analysis methodologies.

Incorporating Fundamental and On-Chain Analysis

Unlike traditional markets, cryptocurrency trends are heavily influenced by specific fundamental and ‘on-chain’ factors. For effective **trade the pool** strategy, consider:

- Macroeconomic Factors: Global liquidity, interest rate decisions by central banks, and geopolitical events increasingly affect Bitcoin and the broader crypto market. Cryptocurrency Market Cap Report

- Regulatory Landscape: News regarding regulatory frameworks, such as the approval of a Bitcoin ETF or changes in Global Prop Firm Regulations, can cause sharp price swings.

- Adoption and Development: Progress in blockchain technology, major network upgrades (e.g., Ethereum’s transition), and institutional adoption are long-term trend drivers.

- On-Chain Metrics: Analyzing data directly from the blockchain—such as the number of active wallets, transaction volume, and exchange balances—provides a unique, unfiltered view of market health and sentiment.

Risk Management: The Core of the Trade the Pool Philosophy

The distinction between a successful and an unsuccessful trader often boils down to risk management. The tight controls imposed by the **trade the pool program** force traders to adopt the necessary discipline.

Mandatory Discipline: Never view the evaluation limits as suggestions. The **Maximum Daily Loss** and **Maximum Trailing Drawdown** are hard rules designed to protect capital. Treat them as non-negotiable boundaries for a professional career.

Position Sizing and Drawdown Control

As a **Crypto Newbie**, you must internalize that no single trade should jeopardize your entire account. Professional trading dictates that risk per trade should be minimal, typically between $0.5\%$ to $1\%$ of your capital. Effective trading essentials, such as always setting a Stop Loss, are not just best practices—they are mandatory components of the prop firm model.

| Metric | Rationale for Funded Traders |

|---|---|

| Maximum Daily Loss | Limits intraday damage, preventing emotional over-trading. |

| Maximum Trailing Drawdown | Protects the firm’s capital and enforces profit retention. |

| Risk-Reward Ratio | Requires a positive ratio ($>1:2$) to ensure profitability even with a moderate win rate. |

Understanding Market Liquidity

Liquidity plays a significant role in market risk, especially in altcoins. Liquidity refers to how easily an asset can be bought or sold without affecting its price. Low-liquidity assets can experience ‘slippage’—the difference between the expected price and the execution price—which can be detrimental to a firm-funded account. Understanding The Importance of Liquidity is key to managing execution risk.

Strategic Advice for Crypto Newbies in the Trade the Pool Program

To maximize your potential in the **trade the pool evaluation program**, consider the following professional strategies:

-

1. Specialize, Don’t Generalize

Focus on one or two asset classes (e.g., Bitcoin and Ethereum) rather than spreading your attention too thin. Mastery over a few charts is more profitable than mediocrity across many. Develop a deep understanding of the trading essentials for those specific assets.

-

2. Consistency Over Home Runs

The **trade the pool funded program** values consistency. A series of small, well-managed winning trades is exponentially more valuable than a few erratic large wins followed by a major loss. The profit target is merely an accumulation of consistent, repeatable positive expected value trades.

-

3. Treat the Evaluation as a Real Account

Adopt the same rigorous risk management and discipline you would use if it were your own life savings. This mindset shift is critical for a successful transition to the funded phase. Furthermore, re-read this guide and the analysis of the **trade the pool The Program** here **[INTERNAL LINK: Re-read this Guide – Current Article Page URL]** as a constant refresher.

Ready to Scale Your Trading Potential?

Stop trading with small capital. The **trade the pool The Program** offers the structure and funding you need to operate at a professional level.

Start Your Funded Trading Journey Now!Conclusion: Trading Your Way to Success with Trade the Pool

The **trade the pool The Program** provides a credible and structured pathway for aspiring professional traders, particularly those beginning in the volatile cryptocurrency markets. It eliminates the barrier of needing substantial personal capital and, more importantly, forces the development of professional-grade discipline through its evaluation structure.

Key Takeaway: For the **Crypto Newbie**, this program is not just about earning profit; it’s a professional education in **trading essentials**, risk management, and the practical application of **technical analysis methodologies** for trend prediction. By dedicating yourself to mastering the rules and cultivating consistency, you can successfully transition into a **trade the pool funded program**.

Are you ready to stop trading with small capital and start your professional journey?

**Trade the pool** is committed to finding disciplined, profitable traders. Explore the Home Page to learn more about the firm’s philosophy.