A new era in financial trading is upon us, and prop firms are leading the charge in offering capital and structure to talented traders. This comprehensive Trade the Pool review for 2025 delves into one of the market’s key players, analyzing its platform, payout structure, and overall value proposition for both experienced and novice investors. Given the rapid evolution of markets like Crypto and Forex, understanding which platform aligns with your goals is paramount. Are you ready to dive into the specifics of what makes this firm tick and how it measures up against the competition?

Understanding Trade the Pool: A Comprehensive Overview

Trade the Pool is a platform designed to provide traders with capital after they successfully complete an evaluation process. It operates primarily in the stock market (equities), offering traders the chance to manage real capital and earn a share of the profits. For a Crypto Newbie looking to diversify or apply their market analysis skills beyond digital assets, this presents a structured and lower-risk entry into traditional markets.

What is Trade the Pool and How Does it Work?

The core mechanism involves an Evaluation or Challenge phase. Candidates pay a fee and must prove their trading ability by hitting specific profit targets while adhering to strict risk management rules (daily and maximum drawdown limits). Success in the challenge leads to a funded account, where the trader shares in the profits. This model mitigates the firm’s risk while fostering disciplined trading.

The primary appeal for many searching for a tradethepool opportunity lies in the ability to trade with substantial capital without putting their own funds at significant risk. This is a game-changer for those who are profitable but capital-constrained. We encourage you to check out more about the platform via the trade the pool homepage.

Key Features of the Trade the Pool Platform

The trade the pool platform is central to the trader experience. It provides the necessary tools and technology to execute trades efficiently. While the specific software may vary, the focus remains on speed, reliable data feeds, and advanced charting capabilities.

- Access to Real Capital: Successful traders manage capital pools, often reaching significant figures, depending on the account size they qualify for.

- Favorable Payout Structure: The firm offers a competitive profit split, which is a major draw for the community, especially as discussed on forums like trade the pool reddit.

- Diverse Asset Access: Primarily equities, offering a vast array of stocks for day trading, swing trading, or position trading strategies.

In-Depth Review: Trade the Pool Payout, Rules, and Fees

Transparency in fees, rules, and the profit-sharing model is crucial for any prop firm. Our trade the pool review examines these elements closely.

The Trade the Pool Payout Structure

The profitability for a funded trader largely hinges on the trade the pool payout structure. Most prop firms offer a high percentage of the profits to the trader, and Trade the Pool is competitive in this regard.

| Payout Highlight | Details | Trader Benefit |

|---|---|---|

| High Profit Split | Traders typically receive a substantial percentage of the net profits generated, often ranging from 70% to 90%. | Maximizes trader earning potential per successful trade. |

| Regular Withdrawals | The platform generally allows for monthly or bi-weekly withdrawals. | Ensures consistent cash flow for funded traders. |

| Performance-Based Scaling | Consistently profitable traders often have their capital allocation increased. | Provides a clear path for professional growth and increased leverage. |

Navigating the Evaluation Rules and Drawdowns

The rules are the non-negotiable part of the journey. The tradethepool evaluation is designed to filter for consistency and risk management.

- Profit Target: A defined percentage gain the trader must achieve within a set time frame.

- Maximum Drawdown: The total loss the account can sustain before the evaluation fails or the funded account is terminated. This is often the hardest rule for traders to follow.

- Daily Drawdown: The maximum loss allowed in a single trading day, enforcing short-term risk control.

Understanding these rules is essential for success. For more insights into risk management strategies, check out News and updates from the world of funded trading [INTERNAL LINK: **News and updates from the world of funded trading** – https://tradethepool.fund/news/].

According to a Q3 2024 proprietary trading industry report, stricter enforcement of daily drawdown limits was cited as the primary reason for failure in prop firm challenges (68% of failed attempts).

Prop Firm Benchmark Report, 2024

Trade the Pool vs. Competitors and Community Feedback

When evaluating a firm, it’s necessary to look at what the trading community says and how it stacks up against others. Competitor analysis is vital for a comprehensive tradethepool reviews assessment.

Community Sentiment: Trade the Pool Reddit

The sentiment on forums like trade the pool reddit is often a raw and unfiltered source of feedback. Common discussion points include:

- **Execution Speed:** Positive mentions of fast order execution, critical for day traders.

- **Customer Support:** Mixed reviews are typical, but recent improvements in response times have been noted.

- **Platform Learning Curve:** Some beginners find the initial setup complex, necessitating dedicated study time.

We encourage readers to conduct their own due diligence, but the general consensus leans toward recognizing the firm’s legitimacy, provided traders strictly adhere to the rules.

Prop Trading Trends for Crypto Newbies

For a Crypto Newbie, transitioning to stocks or a prop firm environment can be beneficial. The highly regulated structure of a platform like Trade the Pool instills discipline that is often lacking in the unregulated Crypto market. Furthermore, many fundamental analysis techniques, while applied differently, are transferable.

- Diversification: Using a prop firm to trade equities adds a vital layer of diversification to a predominantly crypto portfolio.

- Structure: It forces adherence to defined profit/loss limits, a valuable lesson in risk management.

Technical Analysis and Future Trend Predictions for Trade the Pool

Predicting the future of a prop firm involves analyzing its sustainability, market positioning, and adaptation to regulatory changes.

Sustainability and Market Positioning

Trade the Pool has established a niche, particularly in the equities space. Given the growing demand for external capital by skilled traders, the business model is highly scalable. The key to long-term success will be the firm’s ability to:

- Maintain Competitive Payouts: If payout splits decline, traders will migrate to other firms.

- Tech Innovation: Integrating AI tools for risk monitoring and performance analytics will be essential.

- Regulatory Compliance: Adapting to any new regulations imposed on the prop trading industry to ensure longevity.

Prediction: Increased Focus on Hybrid Assets

The trend in financial markets is toward convergence. We predict that the trade the pool platform will increasingly explore hybrid offerings or partnerships that allow funded traders to access a wider range of assets, including select futures or even regulated cryptocurrency futures contracts, catering to the evolving interests of its user base.

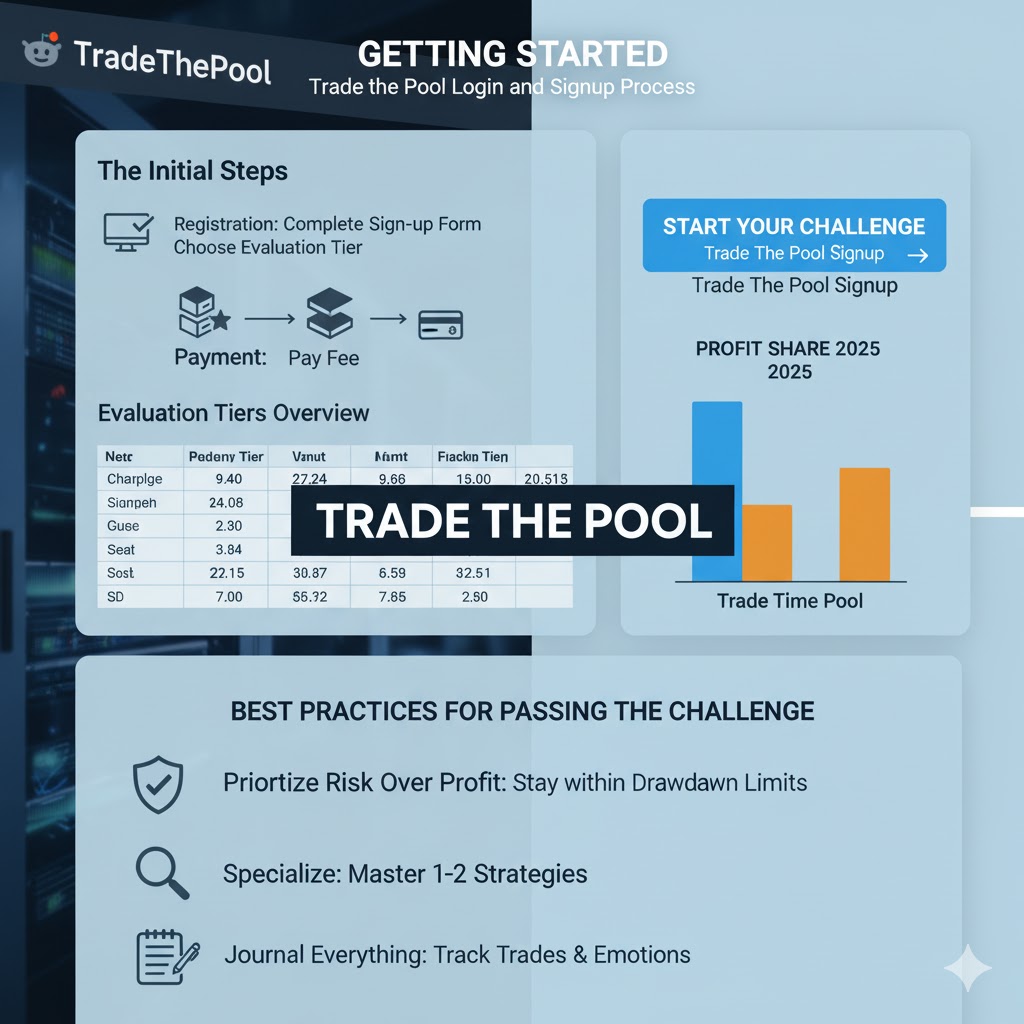

Getting Started: Trade the Pool Login and Signup Process

Ready to take the plunge? The process of signing up and achieving your tradethepool login is straightforward, but it requires commitment.

The Initial Steps

- Registration: Navigate to the official website and complete the sign-up form.

- Selecting the Challenge: Choose the evaluation tier that aligns with your capital goals and risk tolerance.

- Payment: Pay the one-time (or subscription) fee for the evaluation.

Best Practices for Passing the Challenge

Passing the initial evaluation is the toughest hurdle. Here are three professional tips:

- **Prioritize Risk over Profit:** Focus relentlessly on staying within the daily and maximum drawdown limits. A slow, consistent profit is better than an aggressive one that violates a rule.

- **Specialize:** Master one or two strategies instead of trying to trade every market condition.

- **Journal Everything:** Track every trade, the reason for entry, and the emotional state. This is key for self-correction.

For those interested in exploring a potential opportunity, you can initiate the process and learn more about the specific challenge rules by signing up: Trade the Pool Signup.

Ready to Scale Your Trading Capital in 2025?

Take the leap from *Crypto Newbie* to a disciplined, funded trader. Click below to begin your evaluation journey now.

Start Trading with Firm Capital Today!Conclusion: Final Verdict on the Trade the Pool Review

Based on our comprehensive trade the pool review [INTERNAL LINK: **our comprehensive trade the pool review** – Current Article Page URL], Trade the Pool stands out as a legitimate and robust prop firm, especially for those interested in trading equities with significant capital. The firm’s competitive trade the pool payout structure and clear, if strict, rules make it a viable option for disciplined traders.

While resources like the trade pool Reddit offer anecdotal insights, the firm’s professional operation and structured evaluation process offer a tangible pathway to becoming a funded trader. For a Crypto Newbie, it represents an excellent opportunity to institutionalize risk management skills.

We recommend doing your own research and comparing it thoroughly with others in the market. If you are serious about disciplined trading and scaling your capital, taking the evaluation could be your next professional step. Furthermore, staying informed by reviewing global financial news is always beneficial (Global Financial News and Market Data).

Ready to prove your skills and trade with firm capital? Take the next step with trade the pool:

Final Call: Trade the Pool Signup